Whether you’re familiar with ACH or some of its more common names — Direct Deposit, Direct Payment, direct debit, electronic funds transfer (EFT), or an electronic check (eCheck) — you’re already benefiting from its speed, security and ease of use.

When you wake up on payday and see your pay deposited in your account at your financial institution.

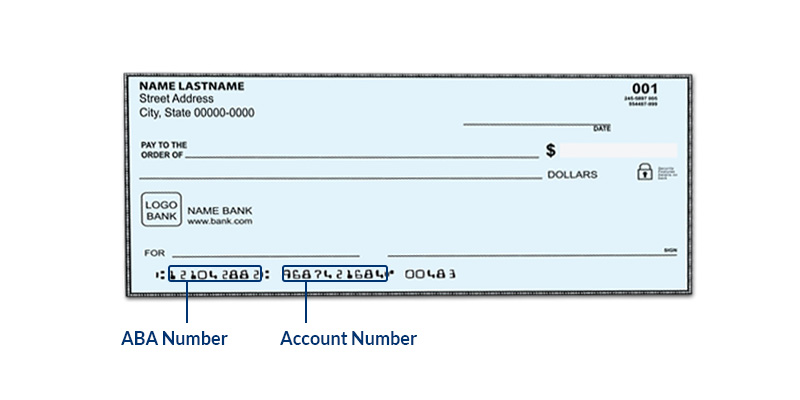

On the Main Menu Page, find the Direct Deposit link 4. Enter your Routing Number, your account number, account type and financial institution 5. Save your changes and close out the Screen or use the link at the top of the page in the gray bar to return to the main menu 6. Your account will be updated in three to seven business days. Into an existing bank account via Direct Deposit or Onto a Direct Express® Debit Mastercard® Direct Deposit is the best electronic payment option for you because it is: Safe – Since your money goes directly into the bank in the form of an electronic transfer, there's no risk of a check being lost or stolen. Direct deposit is the deposit of funds electronically into a bank account rather than through a physical, paper check. It requires the use of an electronic network that allows deposits to take. What is Direct Deposit? Direct deposit is a simple, safe, and secure way to get benefits. If you need us to send your payment to a bank or credit union account, have all of the following information ready when you apply. For taxpayers to track the status of their payment, this feature will show taxpayers the scheduled delivery date by direct deposit or mail and the last four digits of the bank account being used.

When you receive your tax return or Social Security benefit.

When your car loan is paid automatically every month.

Direct Deposit Account Number

That's ACH.

The ACH Network electronically moves money and information from any U.S. bank account to another cost-effectively and securely. ACH payments are everywhere!

Nacha oversees the ACH Network, setting and enforcing strict rules that protect your ACH payments and financial information.

With ACH, personal information is more secure.

Because your money is transferred electronically it is encrypted with bank level encryption, this protects your account, routing number, and other personal information from being compromised.

With ACH, payments are processed fast.

Direct Deposit Account Name

Virtually all regular ACH payments – except those scheduled for a future date or expedited for the Same Day – are settled no later than the next banking day.

Direct Deposit

01

Tell your employer you’d like to be paid electronically with Direct Deposit.

02

Your employer will provide you a simple form that authorizes electronic deposits into your checking and/or savings accounts. We recommend both with Split Deposit.

03

Once the authorization form is finalized, your employer will tell you when to expect to start receiving your pay electronically.

Avoid fees and access your money quickly with Direct Deposit.

With Direct Deposit, electronic payments are made directly into your bank account — there’s no check, and no trip to the bank. It’s just a predictable way of receiving money, and a more convenient way of benefiting from digital tools and money management apps that can help you budget.

Direct Deposit can be used for receiving:

- Wages

- Travel and expense reimbursements

- Pension/401(k) disbursements

- Annuities

- Dividend and interest payments

- Social Security and other government payments

- Tax and other refunds

Direct Deposit is the way 93% of American workers get paid, and 95% of workers are very satisfied with it.

Save every time you get paid with Split Deposit.

Split Deposit allows you to direct a fixed amount or percentage of your pay into a savings or investment account each pay period. You’ll save automatically every time you get paid, and it’s free! Ask your employer if you’re not already using Split Deposit.

Direct Payment

How to use Direct Payment:

- Sign up with companies that send you bills by contacting them directly or logging on to their websites, or

- Use your financial institution’s online banking website or mobile app to make or schedule Direct Payment

Control when you pay your bills with Direct Payment.

With Direct Payment, you can pay for nearly anything electronically.

It’s a no-touch, environmentally friendly way to use your checking or savings account to:

- Pay your monthly bills

- Donate to your favorite charity

- Send money to a friend

- Fund an investment account

- Pay businesses for their products and services

- Make insurance, tax and homeowner association (HOA) payments

- Pay your tuition

- Automatically pay your mortgage, automobile payments, and other loans

With recurring payments, just set it and forget it.

With Direct Payment, you can eliminate the worry of whether or not your check will arrive on time by setting up a recurring payment for things like student loans or mortgage payments.